A Holistic Approach to High-Value Transitions: Business Goals, Personal Values, Financial Independence

One of my favorite books on exit planning and building high value transitions is by Chris Snider and is titled Walking to Destiny. The three legs of the stool, also called “Master Planning,” helps to maximize the business value by ensuring that the owner is personally and financially prepared to reap the highest net proceeds and that there is a plan in place for the big question of what comes next after exiting a business.

These three legs are: 1) an owner’s business plan, 2) their personal engagement plan for post transition, and 3) individual financial needs planning that provides sufficient income to fund all of your post transition needs. All three impact the ultimate value of your business and the success you feel in your life outside of your company. This type of exit planning is an essential part of all functional, long-term wealth management strategies.

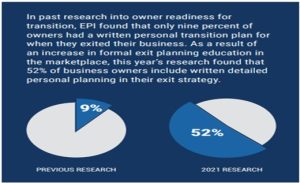

The 2021 New York City State of Owner Readiness Report from the Exit Planning Institute (EPI) found that 99.5% of owners agree that “having a transition strategy is as important to their personal well-being as is the prosperity of their business.”

Building Business Value

Business owners tend to focus more on their business goals than their individual goals or personal financial plan goals. When these three goals are aligned, however, they provide the owner with more value personally and professionally. There is a direct correlation between the value of your business and your deeply held values and goals. When you spend time identifying your internal, financial, and business goals, then you have a clear target. Once you have a target, it becomes a great deal easier to work toward that goal. The only way for that to happen is have a master plan with a clear road map and defined future dates for moving ahead.

By focusing not only the value of what you “own” but, first, what you personally value might be the key to increasing value, increasing satisfaction, and actually hitting the target for what a business owner wants in transition. If you follow an acceleration methodology as a strategic framework for exit planning, you can eliminate some of the wasted time and effort in figuring out which way to go. This system effectively prepares an owner for an exit at any time and is simply a good business strategy. Exit planning is not just a plan, but a process rooted in execution that grows value while expanding options so that an owner can transition on their timeframe and not the time frame of a pending deal. The acceleration method aligns all three legs on the stool, where one gives context to the others.

Begin with the end in mind

One of the biggest regrets of owners without a transition strategy in exit planning is that they failed to integrate the acceleration process to prepare their business and themselves for transition. Owners also realize, after the fact, that they left money on the table because they were not clear about maximizing value before they sold a business. Owners must ask themselves, “Am I satisfied with the current performance and value of my business?“ If they want to improve it, they need to focus on exit planning and how to accelerate the business. The absolute best time an owner can spend is by advancing this concept and considering what would happen to the business and employees if an offer came in today. Is it the right offer and are we ready to make this happen? Much can be said for running this kind of preparedness drill to see what you might yet want to accomplish and what the roadblocks are from being able to say “yes.”

What you value? Your personal goals

As the owner, the key leader, the founder, or whatever title you hold dear, that specific descriptor is the way you have come to view yourself. Some business owners are not prepared to go from the “who’s who” to the “who’s that?” and may, in fact, delay their own timeline because they are not prepared for the change or any potential identity crisis. One leader put it this way, “Once, everyone wanted to schedule a meeting with me and now no one does…”

According to another sobering statistic from the 2021 New York City State of Owner Readiness Report, of business owners with a written business transition plan, 53% included a personal financial independence plan (items include but not limited to income requirements, risk profile, assets held outside of the business, retirement needs, and long-term health).

People, Places, & Purpose

Financial planning provides comfort to the business owners when deciding their next steps. Financial planning especially helps owners to determine what is possible for them after liquidating their business or stepping into a different role. Defining your post ownership or post management retirement cash flow can be different than just wealth accumulation. It is important to take time to consider the people you love, the places you want to be, and what gives your life purpose when doing any type of wealth management. These can take considerable resources if you need or want to make changes. We no longer refer to this transition as “retirement” but more the 3rd Act to a 4 Act play that could be several decades in the making.

The Annual Advance

If you are the main decision maker in your business, you owe it to yourself to carve out time away from the day-to-day pressure of running the business. Talk a full day or more, gather your wise counselors around you, and start building your exit planning stool. Instead of taking a “retreat” mentality, consider it an “advance” and how you can move the company forward. If you run into a roadblock, raise your hand and ask for help. Take time out to consider the three legs on your stool. Do you know what you want? The great news is: if you take the time and get the right people around your table, you will gain incredible clarity for what comes next.

About Scott Eckart

Everyone has a story, and my work begins with discovering it. I emphasize the value of knowing my clients story and value drivers in order to provide them with sound financial advice. I firmly believe that their story leads to clarity, and clarity leads to accomplishment. I have a passion for connecting with people in a way that allows me to design a plan for the life they aspire to live. My process helps my clients to identify a plan and path to take their vision for the future and translate that into a blueprint that can be implemented in an organized fashion.

Everyone has a story, and my work begins with discovering it. I emphasize the value of knowing my clients story and value drivers in order to provide them with sound financial advice. I firmly believe that their story leads to clarity, and clarity leads to accomplishment. I have a passion for connecting with people in a way that allows me to design a plan for the life they aspire to live. My process helps my clients to identify a plan and path to take their vision for the future and translate that into a blueprint that can be implemented in an organized fashion.

I am licensed to sell insurance in the following jurisdictions: Alabama, Florida, Georgia, Illinois, Indiana, Michigan, Minnesota, Missouri, Nevada, New Jersey, Ohio, Wisconsin, Virginia

I am licensed to sell securities in the following jurisdictions: Alabama, Florida, Georgia, Illinois, Indiana, Kentucky, Maryland, Michigan, Minnesota, Texas, Wisconsin, Virginia

I cannot communicate with, nor respond to requests from users who reside in jurisdictions where we are not licensed to conduct insurance and/or securities business.

Scott W. Eckart is a registered representative of and offers securities, investment advisory and financial planning services through MML Investors Services, LLC. Member SIPC www.sipc.org Supervisory office 900 E. 96th Street, Suite 300 Indianapolis, IN 46240 Phone (317)-469-9999. Insurance offered through Massachusetts Mutual and other fine companies

Indiana Business Advisors is the top Indiana business brokerage firm and one of the largest in the Midwest. Whether you are looking to a buy a business or sell a business, Indiana Business Advisors has the expertise and experience to get the deal completed. With over 40 years of history and 2200 businesses sold all over the United States, our team will work diligently to achieve your professional and personal goals.