Benefits of Private Equity – Selling Businesses to PE Firms

It’s no secret that private equity groups, independent sponsors, search funds, holding companies, and family investment offices are actively looking for good acquisitions to add to their deal flow and grow their portfolios. While there are some companies that focus exclusively on turnaround opportunities and distressed businesses, most private investment groups are looking for stable companies with healthy margins and management in place for transition. Business owners shouldn’t view private equity is something dirty or stigmatized and should rather look closely at the benefits of working with them has to offer. This article will explore private equity from an overview level and then will dive into the benefits of selling all or a portion of the business interest to a private equity style group.

Private Investment Overview

Typically, the type of private investment group will be determined by that group’s access to capital. While some groups or firms will pool their own money together, others will utilize money from third parties. What all of these groups have in common is that they invest in large assets with a certain portfolio balance, typically within business and commercial real estate acquisitions. The traditional private equity group has specific acquisition criteria that must be met before they will invest in a business and includes certain industry, margin, adjusted EBITDA, company age, location, and management requirements. Most post these requirements on their websites.

Access to Capital

The first and most obvious benefit to business owners looking to sale or add on a strategic investor for growth is private equity’s access to capital. To be straightforward, the owner is more likely to receive at or above asking price when selling interest to a private equity group. Granted, the business itself will need to meet the group’s acquisition criteria but access to capital is unmatched with other types of buyers. Not only is there access to capital to purchase the ownership interest but access to the funds needed to grow the business and take it to the next level as well.

By adding a strategic partner, businesses can then expand to a level far beyond their capabilities with their own access to capital. While I will not get into deal structures in this article, there are several creative ways that private equity groups can secure funds to close the transaction. The closing ratio and likelihood with a private investment group is substantially higher than with a private or synergistic buyer.

Expertise & Resources

If you or another business owner you know has been approached by a private equity firm, the odds are that you are not the first company they’ve worked with or engaged for purchase. Many of these groups already have platform companies in place that they have been working with to grow for a number of years. Some firms will expand the businesses to a certain point and then sell them while others will hold onto their investments for as long as they continue to make a profit. They have learned lessons both good and bad over the years and are able to put these into practice within their recent acquisitions. Many private equity associates and partners have strong business ownership and entrepreneurship backgrounds where they’ve grown and sold companies of their own. Expertise can be in anything from finance to human resources to marketing and strategic contacts.

Tools for Growth

As stated in the previous section, these firms have the expertise, knowledge, and plenty of resources available. Add those things into their toolkit for growth and you’ve got potential for the acquired company to reach historic levels of revenue and profit. Through the implementation of new technology to streamline efficiencies and cut cost or by simply standardizing and improving processes and procedures, private equity firms have a whole slew of abilities and tools to help companies grow. Many firms have a strategic plan or model that’s put into action as soon as the deal has been closed.

Management Support

You should never consider working with private equity as an adversarial relationship. The group does not want to do harm to your company; instead, the exact opposite is true. Private investment groups want your business to succeed. When the business makes money, everybody involved wins. This includes owners, employees, customers, suppliers, and all other stakeholders. This means that private equity firms are available to provide support, talent, and resources when companies need it most. Gone are the days when businesses have to struggle for months to find the right solution to an operational or employment problem. Again, because the firm wants the business to grow as much as possible, they will actively help the management team build the most operationally efficient organization imaginable.

Exit Strategies Solved

Many owners do not have a clear exit strategy or retirement plan in place. Recent statistics state that between 50-70% of small and medium-sized business owners do not have a clear exit strategy and have not engaged in any type of planning. This is especially alarming as many the majority of companies are owned by individuals at or approaching retirement age. Simply transferring the business to family is not an option for a lot of owners. Enter private equity to solve exit planning woes.

By engaging with a private equity firm early on, the owner is able to establish a clear plan of how long they will continue to actively work for the company and what exactly their retirement looks like. In many cases, the purchase agreement will include planned exit options and at expected, appropriate amount because of the access to capital mentioned previously. At the same time, the owner is able to invest sales proceeds accordingly while still benefitting from the company’s subsequent growth after the initial transaction. In the end, the owner is able to take advantage of private equity’s group access to capital to fund their retirement through return on business investment while the company is transitioned into good hands. The group will continue to provide the remaining employees jobs while maintaining brand integrity, preventing the business from dying with the owner’s exit.

In Conclusion

In conclusion, “private equity’ should never be a dirty phrase or have stigma attached to it. Instead, business owners should welcome private equity firms and other private investment groups with open arms. Not only do the have the capital to pay the business owner what the business is actually worth, they can continue the company’s legacy and help it to grow to the next level. Additionally, private equity firms are the biggest advocates for securing existing labor. They want to keep employees in place, especially if they have been loyal to the organization, are well-trained, and help promote a good company culture. While there are many benefits of selling a business to a private equity group, the biggest benefit is that they strive to create a situation where everybody wins.

Do You Know the Value of Your Business?

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

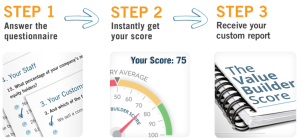

To take the temperature of your business, start the process, take our 13 minute questionnaire by clicking here to get your Business Valuation Score.

Written by Joseph L. Fleenor, Jr. MBA MSA

As a Mergers & Acquisitions Associate with Indiana Business Advisors, Joseph assists advisors throughout the entire transaction process. With his formidable experience in M&A, Joseph is able to inform all stages of the process, from initial valuation, estimates, through due diligence documentation and final purchase. When he’s not doing a deep dive into company financials, Joseph is working hard to ensure that IBA finds the right buyers for our client’s businesses by prepping informational materials and creating targeted marketing lists. As a fellow business owner and prior consultant, Joseph understands the intricacies and complexities that come with navigating corporate finance and strategy.

Joseph comes to IBA with a strong educational background. Joseph earned his Bachelor’s degree from Wabash College in 2012, Master of Business Administration in International Business and International Finance from Butler University in 2018, and Master of Science in Accounting from Purdue in 2021. In addition to his degree, he has a Financial Modeling & Valuation Analysis Certification and is working toward CFA level 1. Before becoming involved in the financial and investment industries eight years ago, Joseph did a term in the United States Army as a multiple launch rocket system crewmember.

Indiana Business Advisors is the top Indiana business brokerage firm and one of the largest in the Midwest. Whether you are looking to a buy a business or sell a business, Indiana Business Advisors has the expertise and experience to get the deal completed. With over 40 years of history and 2200 businesses sold all over the United States, our team will work diligently to achieve your professional and personal goals.