The Importance of Financial Documentation

No matter what anyone says, the whole purpose of going into business or purchasing an existing one is to make money. Ultimately, we live in a capitalistic society and need money to survive and get the things we want. That doesn’t mean that someone can’t love what they do at the same time but let’s not forget the importance of financial documentation within for-profit businesses. If you have been following along in this series and want to build a business for sale, or simply clean up the one that you already have, please take the time to read below about the importance of “clean” financials and regular business valuation.

Avoid Tax Penalties

To begin with and get the big one off the table, please keep the taxman happy. Should you, by some unfortunate circumstance, get an audit notice, you will want to have all necessary financial documentation ready and easily understood. This means keeping track and organizing your receipts in a monthly and yearly fashion. Some online accounting services do the hard work for you. Personally, I use and constantly recommend QuickBooks Online. You can access the information anywhere since it’s web based and it’s straightforward and user-friendly. Additionally, it also has a function to scan in your receipts for transactions via mobile to minimize accounting at the end of the year. I still, however, recommend retaining the paper copies for the purposes previously mentioned.

Accounting Rules & Cash Reporting

Most small businesses owners don’t know the intricacies of Generally Accepted Accounting Principles (GAAP) that United States companies are expected to follow. While private companies can typically “choose” how they perform their accounting and aren’t officially required to use GAAP, it’s highly recommended that a business does so for tax purposes. All IRS forms for business filing is based upon United States GAAP rules and the forms expect the filer to submit any supporting documents accordingly.

Therefore, it is crucial to either learn the rules and apply them to your reporting software (or hard copy books if that’s your thing) or hire a professional. I can’t stress enough how important it is to claim all cash and retain documentation of its receipt. This will become important down the road when the seller wishes to get maximum value for the business because sellers cannot claim cash earnings to increase sales value that are not reported on tax returns.

Getting the Most Accurate Valuation

Now that the tax talk is out of the way, let’s move on to a couple other big reasons why clear and organized financial documentation is important to business owners. Anyone that has recently applied for any type of financing or credit knows all about the list of documents that lenders ask for to complete the underwriting process. Secondly, both me and my organization recommend that every company should have a valuation performed at least every three years. Not only does this show the owner how much their company has progressed with certain initiatives, but it presents a picture of return on investment and how much the company would sell for in the current market.

Financials in Business Exits

The biggest reason of all to have clean financials, outside of getting audited, is to maximize the amount you receive at closing when you exit and transition the business. Most buyers, both strategic and private equity, go through the financial documentation with a fine-tooth comb during the due diligence process to ensure that everything is in order. During this time, they are also looking at what to offer for the company and any discounts that they can justify for offering the seller a lower price.

A lot of confusion and negotiating can be mitigated by having a clean, clear, and consistent financial history. Typically, most buyers will pull certain pieces from the financials (Revenue, Earnings Before Interest Taxes Depreciation Amortization, and Seller’s Discretionary Earnings) to compare against similar, recently closed transactions to generate an offering price.

Taking the Next Steps

To conclude, there are tons of benefits of having your business financial documentation in order. Whether you are getting a routine valuation performed or estimating the net proceeds of a potential sale, having easily understood financials is crucial. Remember, if you are still unsure of what to do next, contact a professional with the right expertise.

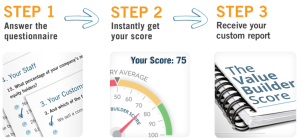

Do You Know the Value of Your Business?

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

To take the temperature of your business, start the process, take our 13 minute questionnaire by clicking here to get your Business Valuation Score.

Written by Joseph L. Fleenor, Jr. MBA MSA

As a Mergers & Acquisitions Associate with Indiana Business Advisors, Joseph assists advisors throughout the entire transaction process. With his formidable experience in M&A, Joseph is able to inform all stages of the process, from initial valuation, estimates, through due diligence documentation and final purchase. When he’s not doing a deep dive into company financials, Joseph is working hard to ensure that IBA finds the right buyers for our client’s businesses by prepping informational materials and creating targeted marketing lists. As a fellow business owner and prior consultant, Joseph understands the intricacies and complexities that come with navigating corporate finance and strategy.

Joseph comes to IBA with a strong educational background. Joseph earned his Bachelor’s degree from Wabash College in 2012, Master of Business Administration in International Business and International Finance from Butler University in 2018, and Master of Science in Accounting from Purdue in 2021. In addition to his degree, he has a Financial Modeling & Valuation Analysis Certification and is working toward CFA level 1. Before becoming involved in the financial and investment industries eight years ago, Joseph did a term in the United States Army as a multiple launch rocket system crewmember.

Indiana Business Advisors is the top Indiana business brokerage firm and one of the largest in the Midwest. Whether you are looking to a buy a business or sell a business, Indiana Business Advisors has the expertise and experience to get the deal completed. With over 40 years of history and 2200 businesses sold all over the United States, our team will work diligently to achieve your professional and personal goals.