Customer Retention & Monthly Recurring Revenue

While many things help to grow business, create long-term sustainability, and make the company more marketable in a sale, having secure and consistent monthly recurring revenue streams ranks at, or near, the top of that list. Recurring revenue comes from general agreements, contracts, or subscriptions. To get the most amount of consistently recurring revenue, business owners need to have a well-executed customer retention plan that keeps people regularly coming back and purchasing. Read below for more information on Monthly Recurring Revenue, Customer Retention, how it helps the business to grow, and the appeal during a potential business sale.

What is Monthly Recurring Revenue?

Monthly Recurring Revenue (MRR) is the amount of money that the business consistently generates on a monthly basis from the same source. This usually comes from ongoing agreements, contracts, or subscriptions with customers or clients. While one-time fees and other one-time transactions are not included in this total, the amount received includes discounts or other benefits for agreement to monthly payment. For some businesses, MRR makes up the entire source of income while it is a small part for others. Although this is becoming more popular with product-based companies, it is largely common among services and technology companies as well.

Why does Customer Retention Matter?

Customer retention is measured by a percentage that is usually calculated by dividing the number of customers that return to the business in a given year, or period measured, by the total number of customers that have purchased within that year. For those that wish to be more accurate, this calculation is performed for the last five years with an average of the five results. This number is extremely important because it tells us how the business is performing and gives us data for a variety of ways to improve revenue-drivers.

First, the customer retention rate gives us a picture of overall customer satisfaction. If the business’s retention rates are low, it is indicative that customers are not happy with the product or service provided, the pricing, or the customer service experience. Obviously, the goal of any company measuring the customer retention rate is to have the percentage as high as possible. Happy customers continue to make purchases and help to grow our MRR amounts.

Analyzing the Data

Secondly, taking a deeper dive into the customer retention rate and looking at the individual customers demonstrates what the company is doing correctly. While some POS and CRM software do this for users, business owners can also look at the data manually to analyze the trends. Key things to look for in retained customers is what they are actually purchasing and at what quantities. Not only does this show us the products or services that we need to market the most, but it also tells management what offerings need to be reevaluated. If something isn’t selling, there’s typically a reason: it’s not something that people actually want, the pricing is wrong, or the item or service is not being marketed effectively. Successful organizations perform customer retention analysis regularly to maximize revenue of top sellers and minimize loss from underperforming portfolio pieces.

Net Promoter Score

Thirdly, retained customers hold a wealth of information themselves. It is totally common for a company to survey specific customers to find out their buying habits and to measure the Net Promoter Score. Essentially, if the customer would refer one of their friends or family members to the business, they receive a positive 1. If they would not, it’s a negative 1. Taking all of this data together, the company’s goal is to stay within the positive range as that indicates that the customer is happy enough to refer and promote the company for free to people they know. A Net Promoter Score is a part of any comprehensive marketing strategy looking to attract the most new customers or clients at the lowest overall cost.

It is worth noting that the business model of some organizations is structured in a way that customers or clients only have the ability to purchase one time per year. In this case, it is more logical to measure retention over a 5-10 period versus taking the average of single years.

How do I Build a Program- to Keep Customers and Grow Revenue?

Increasing customer retention to grow MRR sounds like a daunting task but it’s something that business owners and managers can implement on a small scale and continue to expand over time. At the simplest level, customer names and purchases should be tracked within a database (possibly just an excel spreadsheet if the organization is small) and then asked their satisfaction level with the transaction. As mentioned above, just this small amount of data can be used in a number of ways to make strategic decisions. If customers are not satisfied with something, we need to immediately find out why and potentially change the deficiencies.

Using Technology

At the most complex level, I recommend purchasing a CRM, Customer Relationship Management system, that works with the company’s business model to track is much customer information as possible. The software purchased should be at an appropriate price range for the business size and its needs. Not only do we want to know how often and what customers or clients are purchasing, we also want to know their zip code and other demographic information. All of these pieces of information reveal trends of a targeted buyer type. Additionally, a CRM is used for regular touches with the client and for reminders that keeps the company at top-of-mind so that they make purchases more regularly. Also, a decent CRM should track all subscription and contract data to ensure accuracy, delivery, and store payment information securely.

Why MRR Matters to Buyers

MRR is an extremely appealing piece of the business to potential Buyers. When the closing documents are signed and the keys handed over, the new owner has a much better peace of mind in knowing that there are already consistent revenue flows. Additionally, MRR through contracts and subscriptions can substantially reduce the amount of working capital that a Buyer needs to have on hand and makes the overall business purchase transaction less “expensive.” When it comes to funding the purchase, traditional banks and lending institutions want to minimize risk as much possible. The more consistent monthly revenues are the better because many funding decisions are based on the stability of income, revenue amounts, and the number of clients that produce it. Lending applicants receive more favorable rates for less risky financing options.

Do You Know the Value of Your Business?

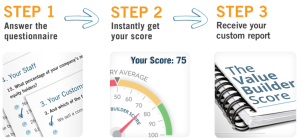

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

To take the temperature of your business, start the process, take our 13 minute questionnaire by clicking here to get your Business Valuation Score.

Written by Joseph L. Fleenor, Jr. MBA MSA

As a Mergers & Acquisitions Associate with Indiana Business Advisors, Joseph assists advisors throughout the entire transaction process. With his formidable experience in M&A, Joseph is able to inform all stages of the process, from initial valuation, estimates, through due diligence documentation and final purchase. When he’s not doing a deep dive into company financials, Joseph is working hard to ensure that IBA finds the right buyers for our client’s businesses by prepping informational materials and creating targeted marketing lists. As a fellow business owner and prior consultant, Joseph understands the intricacies and complexities that come with navigating corporate finance and strategy.

Joseph comes to IBA with a strong educational background. Joseph earned his Bachelor’s degree from Wabash College in 2012, Master of Business Administration in International Business and International Finance from Butler University in 2018, and Master of Science in Accounting from Purdue in 2021. In addition to his degree, he has a Financial Modeling & Valuation Analysis Certification and is working toward CFA level 1. Before becoming involved in the financial and investment industries eight years ago, Joseph did a term in the United States Army as a multiple launch rocket system crewmember.

Indiana Business Advisors is the top Indiana business brokerage firm and one of the largest in the Midwest. Whether you are looking to a buy a business or sell a business, Indiana Business Advisors has the expertise and experience to get the deal completed. With over 40 years of history and 2200 businesses sold all over the United States, our team will work diligently to achieve your professional and personal goals.