Owning Commercial Real Estate Versus Leasing Property – Which is Better?

Whether a business owner is preparing to sell a business or is in the process of building it, one of the most common questions that we hear on a regular basis is: does it make the business more marketable to include commercial real estate, if it exists, or have a commercial lease? The short answer is that it always depends on the business itself and the type of work that is being performed. On the other hand, the long answer is a bit more complex, in-depth, and is discussed below. Please feel free to read on about the benefits of owning commercial real estate and including it in when selling a business or leasing the property, as well as lease benefits and subsequent transfers. Ultimately, the final decision rests with the Seller, but we hope that this information allows for a better-informed decision.

Benefits of Owning Commercial Real Estate

For a lot of companies, operating out of commercial real estate is a requirement. This is especially true for businesses that are asset and equipment heavy, like those operating within manufacturing or industrial industries. It is also true that some retail stores that don’t rely on e-commerce alone must have a bricks and mortar location. While I don’t get too heavy into the tax component of this, especially since every situation is unique and both Buyers and Sellers should rely on a tax accountant for advice, there are certain deductions and schedules available for both the property and subsequent improvements when filing an itemized tax return. Often times, this is the difference between paying taxes or nothing at all. Owners need to be mindful of this when buying or selling a business.

The second most obvious benefit of owning commercial real estate comes with the freedom of controlling the space. Should the business owner decide to make an improvement or has an issue with the plumbing, he or she can make the decision that best suits their needs quickly without having to rely on a property manager and the manager’s timetable/budget. The repair or replacement, as mentioned above, might also be deductible. Owning the real estate allows the business owner to minimize expenses and reduces inoperable times, which quickly eat into profit margins.

Just like with residential property owners, commercial real estate owners can expect to see equity grow as more of the commercial mortgage is paid down and property values in the area increase. Despite recent rate hikes, business owners can still secure a payment that is equivalent to or less than the monthly amount to lease the space. This gives the owner the peace of mind in knowing that the current payment will always be the same amount, unlike the unknown potential increases from a lessor. Fixed monthly payments also make growth and exit planning easier because the space costs don’t change.

Benefits of Leasing Commercial Real Estate

To begin, the most obvious benefit of leasing commercial real estate is reduced upfront cost. Typically, businesses owners wanting to lease commercial space will encounter two types of leases: gross or net. Gross leases involve a specific amount paid monthly or quarterly, calculated annually, that includes all expenses of using the space like insurance, maintenance, and taxes. This is typically better for organizations that have fixed expense needs. Net leases, on the other hand, allow landlords to transfer some risk to the lessee by offering a net lease where the lessee pays the rent and a portion of the expenses (either taxes, insurance, maintenance, or all the above). Net leases are slightly less of a financial burden with a longer occupancy commitment than gross leases but are not as common. Should a business owner choose to do some research, there are also modified gross and modified net leases that take leasing complexity even further.

For the sake of simplicity, let’s assume that a business looking for a lease will opt for a gross lease only. While there is no official standard for gross leases, the usual commitment is for 3-5 years. This is extremely beneficial to a growing business that will need expansion options in the future but lower costs now. The gross lease allows the company to build revenue streams or save capital for a down payment on a property purchase. There are several different ways to use a lease as part of a corporate strategy, but it ultimately depends upon the future goals of the organization and their short-term needs. It is possible that a Buyer in a business sale would prefer to have a lease instead of a mortgage. The Buyer then uses that “down payment capital” to grow the business instead of purchasing the property and increasing liabilities/expense. Sellers need to be mindful of these options when selling a business because of potential leverage opportunities.

Selling or Leasing Your Commercial Real Estate

For business owners that actually own the property where the company operates, there will be some tough decisions made when it comes time to sell the company. The first question that property owners should ask themselves is, “Do you want to be a landlord or not?” In a perfect world, the Buyer simply buys the business outright along with the property in full. Currently, one of the benefits of purchasing the real estate along with the business allows both to fall under a 15 year note under current terms; thus, increasing the typical business purchase term from about 5-10 years to 15 years. We recommend talking to your commercial banker about collateralization.

In many cases, Buyers don’t have the capital for both the enterprise purchase and the real estate at the same time. When this occurs, one of two things usually happens: 1) the deal is structured in a way that an earnout component or Seller Note is included to give the Buyer more upfront capital to purchase both enterprise and property, or 2) the Seller decides to retain the property and lease it to the new owner for recurring income (possibly with the option to purchase later). In other cases, there is some combination of both of those options but depends entirely upon the mutually agreeable final deal structure.

The actual sale and ownership transfer of commercial property works basically how it does on the residential side. Most Buyers will require financing that goes through the traditional process: application, credit check, appraisal, chain of title, etc. Commercial mortgage lenders will also want to see financial documents and projected earnings from the business to ensure viability and business stability. Unlike residential properties, however, a Seller pays a commercial real estate commission of around 6% versus the local residential standard of 3%. Also, a traditional commercial mortgage likely requires a 35% down payment, while SBA 7(a) loans are attained with a down payment between 10-15% for loans up to $5 million. With that in mind, Sellers should remember to be flexible and talk with their broker and advisors to ensure that they are getting the most benefit available within the Buyer’s means. This is why having an experienced mergers and acquisitions advisor that can navigate and negotiate different purchase strategies is important.

Transferring Your Existing Lease to New Ownership

While transferring ownership of commercial real estate follows a similar process of purchasing a home, transferring a lease can get tricky. In most cases that we encounter, the landlord must approve the transfer of the lease before the lessee can sell a business. Depending on the flexibility and cooperation of the landlord, it’s sometimes a deal killer if he or she does not approve the transfer in the event of sale negotiations. If the landlord doesn’t approve of the transfer, the Buyer must either find a new space to lease or terminate the transaction altogether. It is rare that this occurs, but it does happen, and business owners should keep this in mind when preparing to sell a business and engage in talks of succession planning. On the bright side, some leases contain language that prevents the landlord from unreasonably withholding consent to transfer or assign.

Otherwise, the lease transfer process is relatively straightforward after the landlord gives approval. Both parties simply complete an Assignment of Commercial Lease where the Buyer (new lessee) agrees to take over all the obligations and liabilities of the existing lease contract from the Seller (existing lessee). It is strongly recommended that both parties have an attorney review the assignment agreement to ensure that their interests are being protected. If the lease requires a personal guarantee, the original lessee might be required to remain on the lease in second position. The best-case scenario is for the landlord to agree to draft an entirely new lease for the Buyer that completely removes any potential liability on behalf of the Seller. Typically, the new lease will extend past the old lease agreement timeframe and includes higher fee amounts.

Making the Right Decision

Ultimately, the decision rests with the business owner and what works best for them and their company. For some businesses, there is greater benefit to leasing space while for others, it is more beneficial to own the space where the company operates. None of these decisions should be taken lightly and involve the expertise of professionals from a tax, legal, and value standpoint. Indiana Business Advisors and its team of professionals have decades of experience and relationships with external partners to guide both Buyers and Sellers in the right direction. Because we have sold thousands of businesses, our team has navigated every possible hurdle successfully when buying or selling a business and will help you choose the options that best meets your needs with minimal stress.

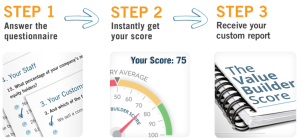

Do You Know the Value of Your Business?

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

To take the temperature of your business, start the process, take our 13 minute questionnaire by clicking here to get your Business Valuation Score.

Written by Joseph L. Fleenor, Jr. MBA MSA

As a Mergers & Acquisitions Associate with Indiana Business Advisors, Joseph assists advisors throughout the entire transaction process. With his formidable experience in M&A, Joseph is able to inform all stages of the process, from initial valuation, estimates, through due diligence documentation and final purchase. When he’s not doing a deep dive into company financials, Joseph is working hard to ensure that IBA finds the right buyers for our client’s businesses by prepping informational materials and creating targeted marketing lists. As a fellow business owner and prior consultant, Joseph understands the intricacies and complexities that come with navigating corporate finance and strategy.

Joseph comes to IBA with a strong educational background. Joseph earned his Bachelor’s degree from Wabash College in 2012, Master of Business Administration in International Business and International Finance from Butler University in 2018, and Master of Science in Accounting from Purdue in 2021. In addition to his degree, he has a Financial Modeling & Valuation Analysis Certification and is working toward CFA level 1. Before becoming involved in the financial and investment industries eight years ago, Joseph did a term in the United States Army as a multiple launch rocket system crewmember.

Indiana Business Advisors is the top Indiana business brokerage firm and one of the largest in the Midwest. Whether you are looking to a buy a business or sell a business, Indiana Business Advisors has the expertise and experience to get the deal completed. With over 40 years of history and 2200 businesses sold all over the United States, our team will work diligently to achieve your professional and personal goals.