Quick Tips for Selling a Business

No matter the organization size or industry, buying or selling a business is complex and requires careful attention and expertise to navigate the many moving parts of the transaction. For many people, the process is overwhelming at times. In order to minimize stress and ensure a successful business exit or acquisition, it’s essential to develop a clear exit strategy and follow best practices throughout the course of the business sale. In this article, we highlight several tips and strategies for owners looking to sell a business, including the business valuation process, current market trends, due diligence, and exit strategies.

Business Valuation for Sales Transactions

Before selling your business or buying another one, it’s essential to determine its value. A business valuation can help you understand the fair market value of your business and ensure that you receive a fair price for your business. There are several methods for valuing a business, including the market approach, income approach, and asset-based approach.

The market approach involves comparing your business to similar businesses that have recently sold. The income approach involves valuing your business based on its future cash flows. The asset-based approach involves valuing your business based on its assets and liabilities. To determine the most appropriate valuation method for your business, it’s important to work with a professional who has experience in business valuation. Valuation professionals can help you understand the strengths and weaknesses of each approach and guide you through the valuation process.

Typically, the market-based approach is the most common for businesses that earn under $50 million in revenue. This business valuation approach for someone looking to sell a business utilizes the data of recently sold businesses in the same industry and of the same size. It is crucial during this process to find companies that are as similar as possible in both business model and financial performance.

Develop a Business Exit Strategy

After finding out what the business is worth, it’s important to develop a business exit strategy before selling a business. An exit strategy is a plan for how the business owner exits the business, including how ownership transfers, navigation of the sale process, and post-sale responsibilities.

An exit strategy is tailored to the specific business type and personal goals of the owner, and should consider factors such as taxes, estate planning, and retirement planning. It’s important to work with a financial advisor or attorney that can help develop a comprehensive exit strategy and ensure that the Seller’s interests are protected throughout the sale process. Typically, the advisor creates a plan based on the amount of money that the Seller receives from selling a business after paying off business debts and taxes on gains. In the business brokers and mergers and acquisitions (M&A) world, this dollar amount is called “net proceeds.”

When looking at a potential business sale, the Seller should envision how they would like the transaction to be completed. What is the maximum amount of time he or she is willing to stay with the business for transition? How open are they to an earn out component? If they own the commercial real estate, do they want to sell it outright or are they comfortable being a landlord or property manager? These are just a few of the key questions the Seller should ask themselves when creating a business exit strategy.

Consider Hiring Business Brokers

If you or someone you know is planning to sell a business, you may want to consider using a business broker. A business broker is a professional who can help you find potential buyers and negotiate the sale of a business. They can also help prepare a business for sale, including valuing the business, creating marketing materials, and conducting due diligence.

When selecting a business broker, it’s important to do research and choose a reputable and experienced professional. Look for a broker who has a track record of success in selling businesses similar in size and industry, and who has a deep understanding of the market and deal structure. While hiring a broker typically comes with a fee, the amount of time and money saved by working with an experienced professional that is actively negotiating the best possible price under the most favorable terms is more than worth it. This is especially true as the business is usually one of the owner’s biggest investments.

Decades of Experience in Buying and Selling Businesses

At Indiana Business Advisors, our team has decades of experience and has bought and sold businesses in nearly every industry imaginable. Not only does our resume look good, but we keep in mind that behind every transaction there are real people, and we strive to help clients meet their personal and professional goals and needs. We understand that business sales can be stressful and actively work to minimize stress for our clients.

Selling a Business – Your Choice

In conclusion, selling a business is a complex process that requires careful planning and consideration. By following these tips and strategies, including the use of business valuation, exit strategies, and business brokers, you can increase your chances of a successful business exit. Remember to work with experienced professionals and to develop a clear strategy that aligns with your wants and needs. Remember, the “right time” is different for everyone and the entire business acquisition and exit process can take a few months or over a year to complete.

Do You Know the Value of Your Business?

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

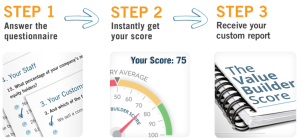

To take the temperature of your business, start the process, take our 13 minute questionnaire by clicking here to get your Business Valuation Score.

Written by Joseph L. Fleenor, Jr. MBA MSA

As a Mergers & Acquisitions Associate with Indiana Business Advisors, Joseph assists advisors throughout the entire transaction process. With his formidable experience in M&A, Joseph is able to inform all stages of the process, from initial valuation, estimates, through due diligence documentation and final purchase. When he’s not doing a deep dive into company financials, Joseph is working hard to ensure that IBA finds the right buyers for our client’s businesses by prepping informational materials and creating targeted marketing lists. As a fellow business owner and prior consultant, Joseph understands the intricacies and complexities that come with navigating corporate finance and strategy.

Joseph comes to IBA with a strong educational background. Joseph earned his Bachelor’s degree from Wabash College in 2012, Master of Business Administration in International Business and International Finance from Butler University in 2018, and Master of Science in Accounting from Purdue in 2021. In addition to his degree, he has a Financial Modeling & Valuation Analysis Certification and is working toward CFA level 1. Before becoming involved in the financial and investment industries eight years ago, Joseph did a term in the United States Army as a multiple launch rocket system crewmember.

Indiana Business Advisors is the top Indiana business brokerage firm and one of the largest in the Midwest. Whether you are looking to a buy a business or sell a business, Indiana Business Advisors has the expertise and experience to get the deal completed. With over 40 years of history and 2200 businesses sold all over the United States, our team will work diligently to achieve your professional and personal goals.