Strategic Planning

First, thank you to all of those who have been following along in this series. I’d now like to take the time to talk about a topic that every business wants and needs but very few have any follow-through: strategic planning. Most large corporations will have a strategic plan and for good reason. It allows them to make decisions based on a plan and a budget. Not only does this improve overall operating efficiency, but the organization is also able to grow while quantitatively measuring the steps along the way. Before we get into why strategic planning makes a business more marketable for sale, let’s first dive into what a strategic plan is and ways to create one.

What is Strategic Planning?

According to Balanced Scorecard Institute, “Strategic planning is an organizational management activity that is used to set priorities, focus energy and resources, strengthen operations, ensure that employees and other stakeholders are working toward common goals, establish agreement around intended outcomes/results, and assess and adjust the organization’s direction in response to a changing environment.” To put all of that into simpler terms, a strategic plan is used to identify certain goals, then make and follow a roadmap to achieve them.

What to Include in a Strategic Plan

The first step is to identify what specific and measurable goals the company has for a certain period. Most strategic plans will be for a five-year period, while others will focus on a year-by-year basis. Next, ownership and management will need to work together to highlight what steps need to be taken and when to complete goals. Third, it is important to create a budget for each of the activities listed. A well-crafted strategic plan will measure and track progress along the way to ensure that everything is staying on course and within budget. Finally, the organization should list how it is measuring success and when “progress reports” are due for review. Those who have the most success review the strategic plan and subsequent initiatives on a regular basis, making any tweaks as needed along the way to ensure return on investment.

Engaging Professionals

It could be more beneficial for larger companies to consult with an individual or group that specializes in planning and goal achievement, but it is entirely possible for a small business to do this on their own with minimal expense. There are tons of resources online and sample templates for free or at a low cost. No matter whether you choose to outsource it or tackle it on your own, be sure to make the best use of the strategic plan and don’t let it just “sit in a drawer” somewhere. You don’t want your time, effort, and money to be another lost expense.

Why Having a Strategic Plan Matters

The biggest justification for building and implementing a strategic plan is the direction and focus that it gives an organization. Companies are able to make decisions and perform actions that will directly impact growth. Generally, it allows them to do so in a way that is more efficient and cost-effective, rather than just throwing “everything at the wall and seeing what sticks.” The review process allows managers to see what works and what needs to be changed for increased revenue. Secondly, buyers are more likely to be interested in a company that is growth-oriented and makes data-driven decisions.

Having a strategic plan in place allows a buyer to step in and continue operating the business in a more seamless way, making the transition process easier on everyone (including employees). Coupling a strategic plan with written policies and procedures allows both employees and management to know what they are doing, when they should be doing it, how they do it, and how success will be measured. Remember, our goal is to make the business the best that it can be to improve marketability when it’s time for transition and sale.

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

Thank you for taking the time to read Exit Strategies: Building a Business for Sale. As part of that process, you may find that you want or need to improve the value of your business, or at least know what that value is. Click here to learn more about business value or start a conversation about yours… Your Business Value.

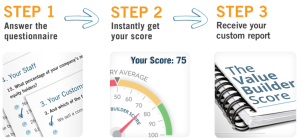

To take the temperature of your business, start the process, take our 13 minute questionnaire by clicking here to get your Business Valuation Score.

Written by Joseph L. Fleenor, Jr. MBA MSA

As Mergers & Acquisitions Associate with Indiana Business Advisors, Joseph assists advisors throughout the entire transaction process. With his formidable experience in M&A, Joseph is able to inform all stages of the process, from initial valuation, estimates, through due diligence documentation and final purchase. When he’s not doing a deep dive into company financials, Joseph is working hard to ensure that IBA finds the right buyers for our client’s businesses by prepping informational materials and creating targeted marketing lists. As a fellow business owner and prior consultant, Joseph understands the intricacies and complexities that come with navigating corporate finance and strategy.

Joseph comes to IBA with a strong educational background. Joseph earned his Bachelor’s degree from Wabash College in 2012, Master of Business Administration in International Business and International Finance from Butler University in 2018, and Master of Science in Accounting from Purdue in 2021. In addition to his degree, he has a Financial Modeling & Valuation Analysis Certification and is working toward CFA level 1. Before becoming involved in the financial and investment industries six years ago, Joseph did a term in the United States Army as a multiple launch rocket system crewmember.

Indiana Business Advisors is the top Indiana business brokerage firm and one of the largest in the Midwest. Whether you are looking to a buy a business or sell a business, Indiana Business Advisors has the expertise and experience to get the deal completed. With over 40 years of history and 2200 businesses sold all over the United States, our team will work diligently to achieve your professional and personal goals.